Enhance your international shipping process and foster cross-border trade efficiency through the strategic implementation of HS codes. These standardized numerical classifications, embraced by customs authorities globally, play a pivotal role in customs clearance, duty assessment, and statistical analysis. Learn the significance of HS codes.

How to Streamline your International Shipping with HS Codes: Shipping Out of Canada Made Easy

HS codes, otherwise known as Harmonized System codes, are standardized numerical classifications that hold immense importance when shipping outside of Canada; whether it’s cross-border or international bound. These codes are used to categorize products for import and export purposes, contributing significantly to ensuring a smooth and efficient cross-border trade experience.

In today’s interconnected global economy, international trade plays a critical role in connecting businesses and consumers across diverse geographical boundaries. However, the complexities of shipping goods across international borders can create significant challenges due to varying regulations and requirements.

Luckily, HS codes provide a solution that greatly enhances the international shipping process and facilitates a seamless trade experience. Whether you are an importer, exporter, or simply interested in the intricacies of international trade, understanding the significance of HS codes is essential for a successful and efficient cross-border business. So, let’s delve into the world of HS codes and explore their impact on international shipping and trade efficiency.

Understanding HS Codes

HS codes, also known as Harmonized System codes, provide more than just alphanumeric classifications for your products. They serve as a golden key that unlocks the potential to simplify customs clearance, facilitate duty and tax assessment, and enable the analysis of international trade statistics. Developed by the World Customs Organization (WCO), HS codes offer a standardized approach to classifying goods. Each product is assigned a unique six-digit code, providing a general classification based on its characteristics, form, or intended purpose. In certain cases, additional digits can be added to offer even more precise insights into specific products.

Benefits of HS Codes in International Shipping

- Accurate Product Identification: HS codes empower customs authorities to accurately identify and classify products during the process of cross-border movement. This accuracy is essential for determining the correct customs duties, taxes, and regulations that apply to each shipment.

- Streamlined Customs Clearance: By including HS codes on your commercial invoices, you can expedite the customs clearance process. Customs officials can promptly verify the nature of your goods and ensure compliance with trade regulations, leading to reduced delays and smoother border crossings.

- Duty and Tax Assessment: Precise HS codes play a pivotal role in determining the applicable duty and tax rates for both imported and exported goods. Ensuring accuracy in classification helps businesses avoid underpayment or overpayment of duties, ensuring adherence to customs requirements.

- Insights Through Trade Statistics: HS codes serve as a cornerstone for collecting trade statistics used by governments and international organizations. These statistics provide valuable insights into the flow of goods across countries, enabling policymakers to make informed decisions and businesses to identify potential markets.

- Risk Management: HS codes are instrumental in identifying goods that may pose risks to health, safety, or security. Customs authorities can subject such shipments to more rigorous scrutiny, ensuring adherence to safety standards and mitigating potential risks.

Navigating the HS Code System

While the benefits of utilizing HS codes are evident, some businesses might find navigating the HS code system challenging. However, there are strategies to streamline this process:

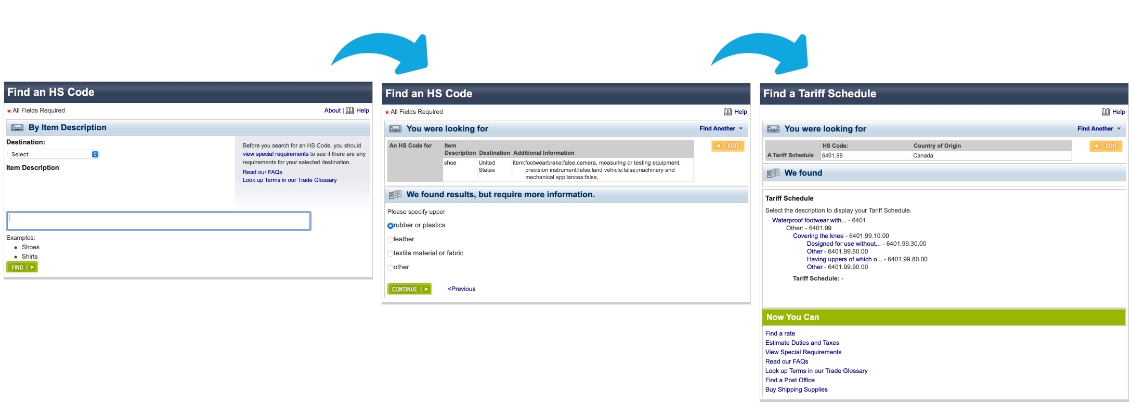

- Leverage Online Tools: Discover the power of various online tools and databases designed to simplify the process of finding the appropriate HS codes. These tools provide valuable resources to identify the most suitable code for your products, such as the Canada Post HS code finder.(To use the link, enter the destination for your shipment and a product description. You will then be asked to answer a few questions about the specifics of your product. Once you’ve answered the questions, Canada Post will generate your HS code)

- Seek Expert Assistance: For complex products or industries, the guidance and expertise of customs brokers or trade consultants can be invaluable. These professionals possess comprehensive knowledge of international trade regulations and can ensure accurate classification, saving you time and effort.

- Stay Updated: As global trade patterns and emerging industries evolve; HS codes are periodically updated. Staying informed about these updates ensures ongoing compliance with the latest regulations and maximizes the benefits of HS code implementation.

HS codes have become integral to optimizing international shipments and fostering global trade growth. Accurately identifying and classifying products empowers businesses like yours to streamline customs clearance, comply with regulations, access trade opportunities, and mitigate risks. By utilizing available resources, seeking expert guidance, and staying updated, you can confidently navigate the HS code system, ensuring efficient and successful international shipping experiences.

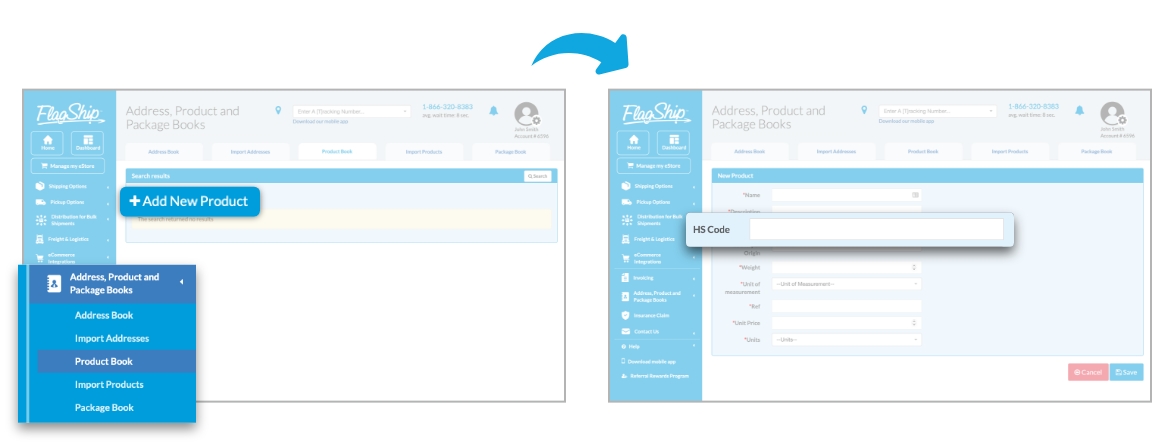

***Note: If you ship the same item(s) regularly, you can save the HS code in the FlagShip online shipping system for future use. In the main menu, go to Address, Product, and Package Book > Product Book and click Add a New Product.

Ready to simplify your international shipments and tap into the full potential of HS codes? Sign-Up for a FREE FlagShip account

FAQ:

Q: What is an HS code?

A: An HS code, or Harmonized System code, is a globally recognized standardized numerical method used by customs authorities to classify trade products.

Q: Why do I need an HS code for my shipments?

A: HS codes are required to accurately identify and classify products when they pass through customs. They help determine appropriate duties and taxes, negotiate trade agreements, maintain trade statistics, and identify goods that may pose risks to health, safety, and security.

Q: How can I find the HS code for my product?

A: You can utilize tools like the Canada Post HS code finder. Simply provide the destination for your shipment and a detailed product description, and the tool will guide you through a series of questions to determine the correct code.

Q: What if I frequently ship the same item(s)?

A: To save time, you can save the HS code in the FlagShip online shipping system for future use. Simply navigate to the main menu, go to Address, Product and Package Book, select Product Book, and click “Add a New Product.”

Q: What if I need assistance with my international shipping?

A: If you require help with your international shipping, our expert shipping team is here to assist you. Feel free to reach out at 1-866-320-8383 or via email at support@flagshipcompany.com .

Q: Can the same product have different HS codes in different countries?

A: Yes, it is possible for the same product to have different HS codes in different countries. While the first six digits of the HS code are globally standardized, some countries add additional digits to further refine the classification, resulting in slight variations.

Q: Can I use a general HS code if I’m unsure about the exact classification of my product?

A: It is crucial to accurately classify your product with the most specific HS code available. Using a general HS code might lead to misunderstandings during customs clearance and could result in delays or penalties. If you are uncertain about the proper classification, consult with trade experts or customs authorities for guidance.

Q: How often do HS codes get updated or revised?

A: The Harmonized System codes are periodically updated to accommodate changes in global trade patterns and emerging industries. These updates usually occur every five to six years to ensure that the system remains relevant and reflects current trade practices.

Q: Are HS codes the same for both imports and exports?

A: Yes, the HS codes used for imports and exports are the same. The codes are employed to classify products regardless of whether they are entering or leaving a country.

Q: Can I use the same HS code for similar but slightly different products?

A: It is essential to use the most accurate HS code for each product, even if they are similar. If the products have significant differences in their composition, intended use, or other characteristics, they may require separate HS codes.

Q: What is the penalty for incorrect HS code classification?

A: Penalties for incorrect HS code classification can vary depending on the specific country’s regulations. In some cases, businesses may face fines, delayed shipments, or even legal actions. It is essential to comply with customs requirements and use the correct HS codes to avoid such penalties.

Q: Can I change the HS code for my product after it has been shipped?

A: Once a product has been shipped and customs clearance has begun, changing the HS code can be challenging. It is best to ensure accurate classification before shipping to avoid any complications during the customs clearance process.

Q: Are there any resources to help me understand HS codes better?

A: Yes, several resources can assist you in understanding HS codes better. Customs authorities often provide guidance on their websites, including official tariff books and HS code databases. Additionally, trade associations, customs brokers, and logistics providers can offer valuable insights and assistance in navigating the HS code system.

Q: Can I self-classify my products, or do I need professional assistance?

A: While businesses can self-classify their products using available resources, seeking professional assistance from customs brokers or trade consultants can be beneficial, especially for complex products or industries. Experts can ensure accurate classification and help businesses comply with customs regulations effectively.

Partner with FlagShip Courier Solutions today. Our expert support team is ready to assist you with shipping inquiries, HS codes, and tailored shipping options. Contact us at support@flagshipcompany.com or call our toll-free number 1-866-320-8383.